A cash flow statement is one of the most essential financial documents for businesses of all sizes. It plays a vital role in providing detailed insights into the cash inflows and outflows of a company over a specific period—whether that’s monthly, quarterly, or annually. Unlike the income statement, which records a company’s revenues and expenses, the cash flow statement focuses solely on cash transactions. This distinction is crucial because it reveals how a company generates and uses cash, which is critical for assessing the business’s overall financial health, liquidity, and solvency.

Cash flow is the lifeblood of a business, as it directly impacts the company’s ability to meet its obligations, invest in new opportunities, and sustain day-to-day operations. Even if a company is profitable on paper, it may face serious issues if it lacks sufficient cash flow to pay its bills, invest in growth, or cover unexpected expenses. A business could be making sales but may not have immediate access to the cash from those sales, which is where a clear understanding of cash flow becomes essential.

For example, if a company has a lot of receivables—money owed by customers—its profits might look strong, but if it can’t collect those receivables promptly, it could run into liquidity problems. Similarly, if a company spends too much on capital investments or operational expenses without securing the necessary financing, it could face cash shortages. By tracking these movements through a cash flow statement, stakeholders, including management, investors, and creditors, can make more informed decisions about the company’s financial strategy.

A comprehensive cash flow statement offers a snapshot of a company’s financial health by showing how much cash is coming in and how much is going out. It allows business owners and managers to monitor their cash position and plan for the future effectively. Whether a business is growing, facing challenges, or looking to attract investors or secure loans, the cash flow statement serves as one of the most reliable indicators of financial stability.

Moreover, it plays a key role in assessing the company’s ability to generate enough cash to cover its debt obligations, pay dividends, or reinvest in the business. It helps business owners and financial analysts to understand whether the company is self-sustaining, or if it relies heavily on external financing to support its operations. For businesses looking to expand, a positive cash flow allows for reinvestment into the business for new projects, equipment, or hiring new employees, helping to fuel future growth.

Understanding and maintaining a healthy cash flow is essential for long-term success. Without it, even the most profitable businesses can face financial difficulties that may prevent them from paying suppliers, creditors, or employees. As such, creating and regularly reviewing a cash flow statement becomes an integral part of effective financial management.

What is a Cash Flow Statement?

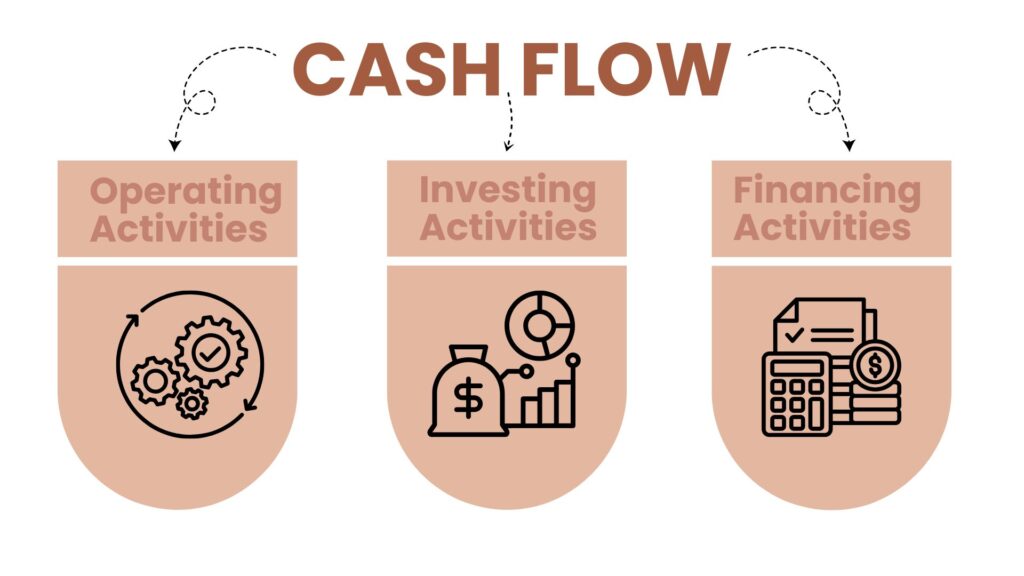

The cash flow statement provides a detailed summary of a company’s cash movements, categorized into three primary sections: Operating Activities, Investing Activities, and Financing Activities. Each of these categories gives valuable insights into different aspects of a company’s financial performance and strategy, helping stakeholders to understand how the company is managing its cash flow.

1. Operating Activities

The operating activities section of the cash flow statement focuses on the core business activities that generate revenue and incur expenses. This section reflects the cash inflows and outflows directly related to the production and sale of goods or services. Essentially, it reveals how much cash the company is bringing in from its operations and how much cash it is spending to maintain those operations.

Cash inflows in this section typically include:

- Revenue from Sales: Cash received from customers for products or services sold.

- Receipts from Interest and Dividends: Cash received from investments or financial assets that are part of the core business operations.

Cash outflows include:

- Operating Expenses: Payments for items such as salaries, utilities, rent, and raw materials.

- Interest Payments: Any interest the company needs to pay on its outstanding loans or borrowings.

- Taxes Paid: Cash outflows related to tax obligations, which are crucial for understanding the net effect of business operations.

The operating activities section is a crucial indicator of a company’s ability to generate sufficient cash from its core operations, which is important for maintaining liquidity and ensuring the company can continue running without having to rely on external financing.

2. Investing Activities

The investing activities section focuses on the purchase and sale of long-term assets and investments. This section provides an understanding of how the company is allocating cash towards assets that are expected to provide value over the long term. These activities typically involve large, one-time expenditures, such as the acquisition of property, equipment, or securities, and their corresponding proceeds from the sale of these assets.

Cash inflows in this section generally include:

- Proceeds from the Sale of Assets: Cash generated from selling property, equipment, or securities.

- Proceeds from the Sale of Investments: Any return or earnings realized from the liquidation of long-term investments such as stocks, bonds, or other securities.

Cash outflows include:

- Purchases of Property, Plant, and Equipment (CapEx): Expenditures on physical assets like machinery, buildings, or land.

- Acquisitions of Investments: Cash spent on acquiring other businesses, investments, or securities.

Understanding the investing activities section helps stakeholders assess how the company is reinvesting in itself for growth, whether through the acquisition of new assets or strategic investments. Excessive spending in this area without sufficient cash inflows could raise concerns about the company’s liquidity. On the other hand, positive cash inflows from asset sales or strategic divestitures could indicate good financial management.

3. Financing Activities

The financing activities section tracks the flow of cash between the business and its owners or creditors. This section shows how the company is obtaining or returning funds to finance its operations, investments, and growth. It reflects the company’s capital structure, including its mix of debt and equity financing, as well as the repayment of debts and distribution of dividends.

Cash inflows in this section often include:

- Proceeds from Issuing Stock or Bonds: Money raised by issuing new shares of stock or bonds to investors.

- Borrowings: Cash received from loans or credit lines obtained by the company.

Cash outflows typically include:

- Repayment of Debt: Payments made to reduce or eliminate outstanding loans or borrowings.

- Dividend Payments: Cash payments made to shareholders as a return on their investment.

- Repurchase of Stock: Cash spent on buying back company shares from the market.

The financing activities section helps investors, creditors, and business owners understand how the company is managing its capital—whether through debt or equity—and how it plans to meet its financial obligations. For example, large inflows from issuing stock may suggest the company is looking to expand, while significant outflows for debt repayments or dividends could signal efforts to return value to shareholders or reduce leverage.

Conclusion

Together, these three sections—Operating Activities, Investing Activities, and Financing Activities—offer a comprehensive view of a company’s cash flow, helping investors, managers, and other stakeholders evaluate how effectively the company is managing its finances. While operating activities show how the company’s core business is performing, investing activities provide insight into its long-term strategic planning, and financing activities demonstrate how the company funds its operations and growth.

By understanding and analyzing these sections of the cash flow statement, business owners and investors can make informed decisions regarding the financial stability and future prospects of the company. Maintaining a balance between these areas is key to ensuring a healthy cash flow, which in turn supports the long-term growth and sustainability of the business.

Why is the Cash Flow Statement Important?

1. Liquidity Management

Liquidity management is crucial for business success, as profitability does not guarantee sufficient cash flow to meet financial obligations. Companies may face liquidity issues if they cannot access cash quickly, particularly when sales are on credit or payments are delayed. The cash flow statement provides essential insights into cash inflows and outflows, helping businesses track operational cash and expenditures. Regular monitoring allows for early identification of liquidity shortfalls, facilitating timely adjustments such as securing financing, negotiating payment terms, or delaying expenses to maintain operational stability and support growth.

2. Financial Planning and Decision Making

A well-prepared cash flow statement serves as a critical tool for financial planning and decision-making. It helps business owners and investors evaluate the timing and availability of cash, ensuring that the company can meet short-term expenses without jeopardizing long-term financial goals. By analyzing the cash flow statement, managers can make informed decisions on how to allocate resources, whether that’s reinvesting in the business, securing loans for expansion, or cutting costs in response to cash flow concerns.

The cash flow statement helps businesses forecast future cash requirements, such as paying bills, servicing debt, or funding capital projects. It also allows investors and business owners to assess whether the company is generating enough cash to support growth initiatives or whether additional financing is needed. For example, if a business is planning to expand or launch new products, reviewing cash flow patterns can provide insight into how much capital is required to execute the plan successfully. Cash flow analysis can even help determine whether it’s a good time to seek financing, invest in new opportunities, or delay expenditures. In this way, the cash flow statement becomes a vital tool for making both short-term tactical and long-term strategic decisions.

3. Assessing Business Performance

While the profit and loss (P&L) statement provides valuable information about a company’s profitability, it doesn’t give a complete picture of the company’s financial health. The P&L statement only reflects income and expenses, not the actual movement of cash in and out of the business. A company could be profitable according to the P&L, but if its cash inflows are delayed or insufficient, it could still face financial difficulties.

The cash flow statement is essential for providing a clear view of a company’s liquidity, revealing whether it generates enough cash to sustain operations, pay employees, manage debt, and invest in growth. It helps stakeholders assess the timing and sufficiency of cash flows, highlighting potential risks if negative cash flow persists, which could indicate difficulties in converting profits into liquid assets and threaten the company’s long-term viability. Thus, while profitability matters, the cash flow statement is vital for evaluating a company’s operational functionality and growth potential.

4. Creditworthiness

For lenders, investors, and other external stakeholders, the cash flow statement is a key document when assessing a company’s creditworthiness. While a company’s profit and loss statement or balance sheet might show a healthy profit or strong assets, the cash flow statement provides a more transparent picture of the company’s ability to meet its obligations and repay its debts. Lenders, for instance, are less concerned with whether a company is profitable on paper and more focused on whether it generates enough cash to cover its loan repayments.

A healthy cash flow assures lenders and investors that the business can meet its debt obligations without risking default. It also shows the company’s ability to manage its finances effectively, generate sustainable returns, and grow without facing financial strain. If a business consistently has a positive cash flow, it will be seen as a low-risk investment or lending opportunity, making it easier to secure financing or attract investors. On the other hand, if a company has a negative cash flow for extended periods, it may raise concerns about the business’s viability and repayment capacity, making it more difficult to obtain loans or investment funding.

In conclusion, the cash flow statement serves as an essential tool in liquidity management, financial planning, performance assessment, and creditworthiness evaluation. Whether a business is looking to ensure it can meet immediate financial obligations, make strategic decisions, or secure financing, the cash flow statement offers the transparency and insight necessary to maintain financial health and stability. Proper cash flow management is key to sustaining operations, supporting growth, and achieving long-term success in any business.

How to Read a Cash Flow Statement

Understanding a cash flow statement involves carefully examining the balance between cash inflows and outflows. Cash flow is the movement of money into and out of a business, and the cash flow statement tracks this activity over a specific period. By reviewing this statement, you can assess whether the company is generating enough cash to support its operations, pay its bills, invest in growth, or distribute dividends.

When the cash flow is positive, it means that the company is receiving more cash than it is spending during the period. This is generally a good sign of financial health and stability. Positive cash flow indicates that the business has sufficient liquidity to cover its expenses, invest in new opportunities, and meet its financial obligations without the need to borrow or secure additional funding. A company with positive cash flow can typically reinvest its earnings into expansion or innovation, fund future growth, and strengthen its financial position.

In contrast, negative cash flow occurs when the company is spending more cash than it is receiving. This situation can be alarming, as it suggests that the company is not generating enough cash from its operations or investments to sustain its day-to-day activities. While a company may still be profitable on paper, negative cash flow can lead to liquidity problems, which could have serious consequences if not addressed promptly. For example, a company with negative cash flow may struggle to pay suppliers, employees, or debt obligations.

Persistent negative cash flow could indicate several issues, such as declining sales, inefficient operations, high debt levels, or poor cash management practices. If a business doesn’t have a plan to address negative cash flow, it could face financial difficulties, including the inability to secure loans or investments, or even risk insolvency. It’s crucial to identify the root cause of negative cash flow and take corrective actions, such as improving collections from customers, reducing operating costs, or renegotiating terms with suppliers and creditors.

In summary, a positive cash flow is a clear indication of a company’s ability to sustain itself, grow, and meet financial obligations, while negative cash flow signals potential financial distress that requires attention and strategic action to avoid future liquidity problems. Proper management of cash flow is essential for maintaining the ongoing financial stability of a business.

Common Terms in a Cash Flow Statement

- Cash from Operations: This is the cash generated by a company’s core business activities, excluding any income from investments or financing activities.

- Capital Expenditures (CapEx): This refers to money spent on long-term assets like property, equipment, or facilities.

- Free Cash Flow (FCF): Free cash flow is the cash left after covering capital expenditures, which can be used for reinvestment, paying down debt, or distributing dividends to shareholders.

Improving Your Business’s Cash Flow

If your cash flow statement shows negative cash flow, it may be time to assess your financial strategies. Some practical ways to improve cash flow include:

- Reduce Expenses: Cutting unnecessary costs can increase your available cash.

- Improve Collection Times: Speeding up payments from customers and offering early payment discounts can increase cash inflows.

- Manage Inventory Efficiently: Holding excess inventory ties up cash, so it’s crucial to streamline inventory management.

- Consider Financing Options: If you’re facing short-term cash flow issues, exploring financing options such as lines of credit or short-term loans can provide relief.

How We Can Help

At GoWin Accountants Ltd, we understand that managing cash flow is key to your business’s success. Our expert accountants can help you prepare and interpret your cash flow statement, ensuring you have the right financial information to make informed decisions. We also offer personalized financial strategies to improve your cash flow and maintain a healthy financial outlook.

Contact Us Today!

For more information or if you need assistance with your cash flow statement, don’t hesitate to reach out to us. You can call us at: 01256 578 106, or email us at: admin@gowinaccountantsltd.co.uk. We’re here to help you achieve financial stability and success!

By understanding the importance of a cash flow statement, you’re taking the first step toward strengthening your business’s financial foundation. Whether you’re looking to improve liquidity, streamline operations, or make sound investment decisions, the cash flow statement is a critical tool in your business management toolkit.